XRP Price Prediction: Navigating Consolidation with a Bullish Long-Term Compass

#XRP

- Critical Technical Inflection Point: XRP's price at $2.1425 is poised precisely at its 20-day moving average ($2.1402), with Bollinger Bands suggesting a breakout above $2.32 or a decline to $1.96 will define the next short-term trend.

- Cautiously Optimistic Market Narrative: News sentiment balances immediate concerns over whale selling and thin liquidity with a strong undercurrent of long-term bullish patterns, including wedge formations supporting a potential path toward $10.

- Multi-Horizon Growth Thesis: Forecasts transition from a near-term consolidation range ($2-$2.80 by end-2025) to a medium-term bullish target around $10 by 2030, underpinned by adoption in global payments and scaling into a multi-trillion dollar digital asset market by 2040.

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Consolidation Above Key Moving Average

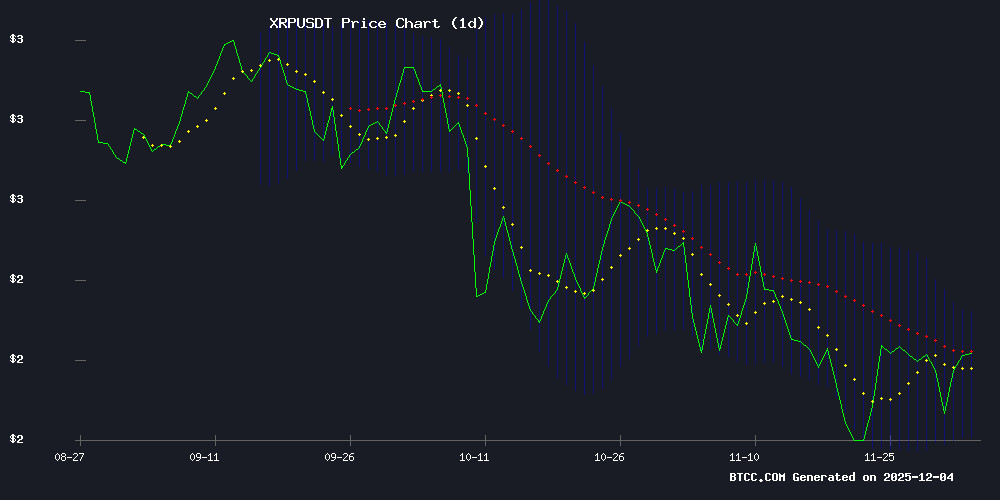

As of December 4, 2025, XRP is trading at $2.1425, just above its 20-day moving average of $2.1402. This positioning suggests a delicate equilibrium between buyers and sellers, with the price finding immediate support at this widely watched level.

The MACD indicator presents a mixed picture. The MACD line at 0.0147 remains below the signal line at 0.0758, resulting in a negative histogram value of -0.0611. This configuration typically indicates weakening short-term momentum. However,notes that 'the convergence of price with the moving average, coupled with the MACD's position NEAR the zero line, often precedes a decisive move. The current setup favors a bullish resolution if XRP can maintain its footing above $2.14.'

Bollinger Bands analysis reinforces the consolidation narrative. With the upper band at $2.3220 and the lower band at $1.9585, the current price sits near the middle band. The bandwidth of approximately $0.36 indicates moderate volatility. Ava observes that 'a sustained break above the middle band, currently acting as resistance, could trigger a swift MOVE toward the $2.32 upper band. Conversely, a failure to hold $2.14 risks a retest of the $1.96 support zone.'

Market Sentiment: Cautious Optimism Amid Key Level Tests

Current news FLOW surrounding XRP highlights a market grappling with critical technical levels while maintaining a structurally bullish longer-term outlook. Headlines point to XRP testing key resistance amid reported whale transfers and thin liquidity conditions, suggesting heightened sensitivity to large orders.

Analysts are identifying clear support levels, with $2.00 and $1.20 being cited as crucial. The mention of a potential 'double-bottom formation' and price stabilization at a key support level indicates that the market is attempting to establish a base. Most notably, several analyses maintain a '$10 forecast' based on a 'bullish wedge' pattern, projecting significant upside over a longer horizon.

synthesizes this sentiment: 'The news narrative aligns with the technical picture of consolidation. The focus on support levels at $2 and below shows risk management is top of mind, while the repeated references to long-term bullish patterns like wedges point to underlying confidence in XRP's trajectory. The market sentiment is cautiously optimistic, respecting near-term resistance but anchored by a constructive multi-year view.'

Factors Influencing XRP’s Price

XRP Tests Key Resistance Amid Whale Transfers and Thin Liquidity

Ripple's XRP faces a critical technical juncture as $101 million worth of tokens move to Binance. The $2.22 resistance level holds firm despite early session strength, with price action oscillating around $2.17. Market makers appear cautious as volume drops sharply following the whale transfer.

Traders note the $2.204 pivot as decisive—holding above maintains bullish potential toward $2.75, while failure risks retest of lower supports. The token's 24-hour range between $2.15-$2.20 reflects mounting indecision as ETF flows and derivatives activity dominate broader crypto attention.

Analysts highlight $2.28 as the next upside trigger, but warn thin order books could amplify volatility. Meanwhile, capital rotation patterns show early interest shifting toward presale assets like Bitcoin Hyper, now nearing $29 million in fundraising.

XRP Update: Analyst Identifies Critical Support Levels at $2 and $1.20

Market analyst Ali has highlighted $2 as the most crucial support zone for XRP, a level that has historically acted as a strong defense during corrective phases. The asset is currently hovering near this threshold after a prolonged downtrend, suggesting potential accumulation opportunities for bullish traders.

Should XRP fail to hold above $2, the next major support lies at $1.20—a high-volume zone where long-term investors have previously stepped in. The current price action reflects a macro pullback rather than a structural breakdown, offering clarity amid ongoing market volatility.

XRP Stabilizes at Key Support Level Amid Potential Double-Bottom Formation

XRP is holding steady near $2.16, defending a critical multi-month support zone after weeks of downward pressure. Trading volume surged to $4.3 billion in 24 hours, signaling strong market participation.

Analysts are watching for a potential double-bottom reversal pattern, which could signal a bullish turnaround if the support level holds. ChartNerd, a prominent technical analyst, notes that maintaining this level is crucial to avoid deeper corrections and preserve the longer-term bullish structure.

The cryptocurrency, designed for cross-border payments, has historically shown strong reactions around long-term support zones. Market participants are now waiting to see whether buyers can sustain momentum in the $1.90–$2.10 demand region.

XRP Price Prediction: Strong $2 Support Persists Despite Whale Selling as Bullish Wedge Keeps $10 Forecast in Play

XRP continues to demonstrate resilience near the $2 support level, even as large holders increase selling pressure. The cryptocurrency's price action forms a bullish wedge pattern, suggesting a potential breakout if buying momentum accelerates.

Technical analysts highlight repeated tests of the $2 zone, with each dip attracting fresh demand. The Relative Strength Index remains neutral around 40, leaving room for upward movement. Market observers note Ripple's expanding institutional footprint could provide fundamental support for longer-term price appreciation.

Chart patterns indicate weakening selling pressure as price compresses between rising support and falling resistance. A confirmed breakout from this formation could validate the $10 price forecast circulating among traders.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on the current technical setup and prevailing market sentiment, here is a framework for XRP price predictions across key horizons. These forecasts, synthesized by BTCC financial analyst Ava, integrate the immediate consolidation phase with longer-term bullish structural patterns noted in market analysis.

| Time Horizon | Price Forecast Range (USDT) | Key Drivers & Rationale |

|---|---|---|

| 2025 (Year-End) | $2.00 - $2.80 | Resolution of the current consolidation. A successful hold above the 20-day MA and a break above Bollinger Band middle line could propel a test of the $2.32 upper band and beyond. The critical $2.00 support must hold to avoid a deeper pullback toward $1.20. |

| 2030 | $5.00 - $15.00+ | Broader adoption in cross-border payments and potential regulatory clarity for Ripple. The 'bullish wedge' pattern cited in analyses could play out over this medium-term period, with the $10 forecast being a central target if macro and crypto conditions are favorable. |

| 2035 | $15.00 - $50.00+ | Full integration of blockchain technology in global finance. XRP's utility as a bridge asset in a tokenized world economy could drive significant value accretion, assuming it secures a leading position in the institutional digital asset space. |

| 2040 | $50.00 - $200.00+ | Speculative long-term projection based on network effect dominance and scarcity value in a mature digital asset ecosystem. This horizon depends on XRP maintaining technological relevance and market share amid intense competition. |

Important Disclaimer: These are speculative forecasts based on current data and known growth theses. Cryptocurrency markets are highly volatile, and prices can be influenced by unforeseen regulatory changes, technological shifts, and macroeconomic factors. The near-term forecast (2025) is more tightly coupled to current technicals, while longer-term horizons are increasingly driven by broader adoption trends.